The microchip industry’s value to the global economy is almost unquantifiable owing to the fact that it facilitates other key industries that our society holds in high regard. Industries such as: Computing, telecommunications, military, utilities, health care, energy and transportation require chips to manufacture products that benefits your daily life directly and indirectly.

Why Microchips are so important

The dependence on microchips was realised throughout the pandemic. Due to the pandemic microchip production was severely impacted. Factory shutdowns, logistical challenges, and increased demand for electronic devices strained the supply chain, which exacerbating existing geopolitical tensions. This created a chip shortage which we are still feeling the effects of today. The shortage initially began because of a delay in production caused by factories shutting down due to the emergence of the COVID-19. Simultaneously, remote working increased the demand for improved telecommunication, creating a strain on the supply chain.

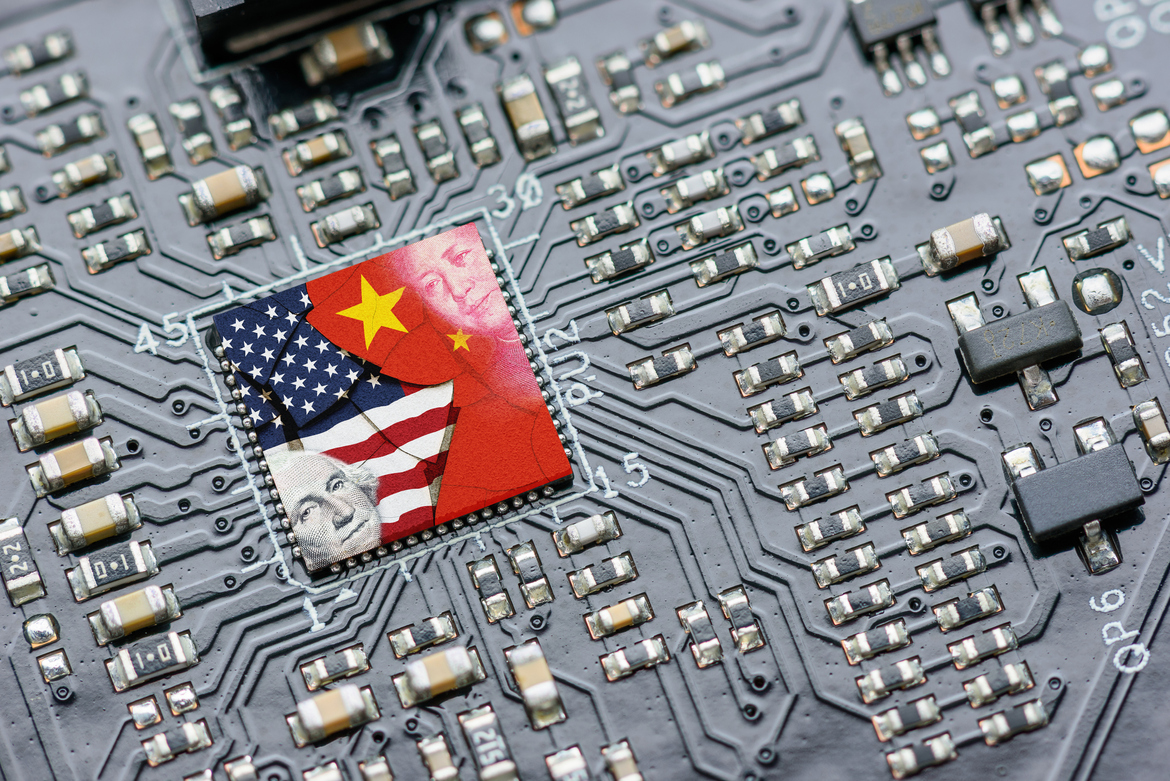

USA and China Trade tensions

The ongoing trade dispute between the United States and China has had a profound effect on the microchip supply chain. Starting off with the previous presidency of Donald Trump first imposing a 25% trade tariff on imports from China in 2018. This was done because the US believes the Chinese government were not doing enforcing their Intellectual Property (IP) laws, which lead to malpractice and exploitative behaviour from Chinese corporations. From these unconventional practices the US believes that China uses the information garnered to improve their military equipment.

The Biden administration has inherited Trumps previous tariffs and going a step further with the U.S. Department of Commerce (DoC) blacklisting and imposing restrictions on certain Chinese tech companies, one of those companies is Semiconductor Manufacturing International Corporation (SMIC), they are one of the largest semiconductor manufacturers in Asia. The inability to source U.S. based parts to manufacture small chips had significant ramifications for the supply chain. Several companies, including Huawei Technologies Co., had anticipated such actions and began stockpiling chips as early as 2019. This has affected the flow of critical components, equipment, and technology needed for microchip production, as well as market access for chip manufacturers.

China retaliated by not allowing Micron, one of the biggest tech companies in the US, to trade with Chinese tech corporations. The Cybersecurity Administration of China said that Micron failed its security review and barred operators of key domestic infrastructure from purchasing Micron’s products. It had neither provided details on what risks it had found nor what Micron products would be affected.

Modern Day Cold War

Governments worldwide have implemented export controls and sanctions on various countries, companies, and technologies, affecting microchip production and trade. These measures can limit access to essential materials, equipment, and expertise, leading to delays and supply chain disruptions.

Similarly to the cold war of the 20th century, the two biggest global powers of today are trying to increase their soft power efforts to influence smaller nations to align with their ideology. The Dutch government has introduced new rules to restrict the export of certain advanced semiconductor equipment, citing national security concerns. It is believed there was pressure from the United States to limit the sales of high-tech components to China. The legislation will take effect on September 1st, 2023, require companies manufacturing advanced chipmaking equipment to obtain a license before exporting it.

Another example is the U.S. State Department collaborating with the Government of Panama to explore opportunities for growing and diversifying the global semiconductor ecosystem through the International Technology Security and Innovation Fund.

With Micron facing issues in operating in China. Micron announced they will be expanding their global supply chain by setting up a new manufacturing site in India. The facility will cater to global customers as well as the Indian market. This comes as India Prime Minister Narendra Modi visited the US to discuss co-development and co-production opportunities with President Joe Biden.

China has called out the Australian government for blocking a bid by a Chinese-linked company to boost its ownership in a rare earth’s supplier. That was the second, in recent times that the Australian government has blocked Chinese lead investment into their mineral industry. Australia has previously said it would become more selective about who it allows to invest in its critical minerals industry, as they have concerns about creating monopolies.

The Role of Taiwan

Taiwan is a significant player in the semiconductor industry, and any tensions between Taiwan and China can impact the microchip supply chain. China views Taiwan as a part of its territory and has occasionally tried to assert control over the island. Such geopolitical instability creates uncertainties in the supply chain and hinder investments in Taiwan’s semiconductor sector. TSMC is the largest semiconductor chip manufacturer and is headquartered in Taiwan. The company produces about 90% of high-performance chips across the globe. It controls over 50% of the global semiconductor foundry market in terms of revenue.

The US believes if China is successful in an occupation of Taiwan, the highly coveted microchips that TSMC produces will be used to further strengthen the Chinese military. Russia’s invasion of Ukraine may prove to be a precursor of how China may invade Taiwan. This is why the US is further increasing their presence in the South China sea. The government of The Philippines recently granted access for the US to use their military bases. With this strategy of creating a military barrier from Japan down to The Philippines the US hopes the increased military presence in the Pacific will deter any provocation from China onto Taiwan.

Final Thoughts

Many of the economically developed nations have made or are in the process of increasing their domestic microchip supply chain. In April 2023 the European Chips Act was announced. With the aim to boost Europe’s technological sovereignty, competitiveness, resilience and contribute to the digital and green transitions.

The UK has outlined the National Semiconductor Strategy. This strategy sets out the plan of up to £1 billion of government investment will boost the UK’s strengths and skills in design, R&D and compound semiconductors, while helping to grow domestic chip firms across the UK.

These new legislation from governments started with the US CHIPS Act that became law in January 2021. The US DoC unveiled its vision to enhance the semiconductor supply chain in the United States. As part of the CHIPS for America investments, the DoC has announced funding opportunities for large semiconductor supply chain projects. These projects encompass materials and manufacturing equipment facility initiatives with capital investments of $300 million and above. In the autumn, a separate application process will be released for smaller projects that fall below this threshold.

These new strategy shows a shift in modern age of globalisation. Up until now Taiwan holds market dominance in the Microchip industry and a key to the global supply chain. However, the ever-increasing threat of China looming, a shift of governance in Taiwan would be damning to the Microchip supply chain. So, to mitigate this, countries are heavily funding their domestic chip market.