Group Futurista’s Future of Digital Supply Chain in a Post-COVID world (FODS 3.0) conference happened last month and I had the pleasure of both attending the event and moderating the event’s Q&A, “Digital Supply Trends of 2021: What new changes will prevail.” Before FODS 3.0 took place, I wrote a pre-event piece titled “Is Technology the Right Solution to the COVID-19 Supply Chain Challenges?” As expected, the event looked at how COVID hit the supply chain, and there were some great learning points presented throughout. Furthermore, some of the presenters lived up to my expectations and didn’t just pitch products, they helped to educate along the way. I’d like to focus on what was new or unique, and finally, I’ll close off with one of the more interesting visions for tomorrow that was presented.

The Impact of COVID

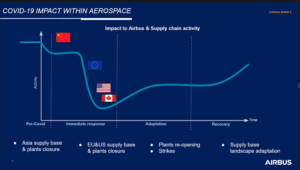

COVID did not spread uniformly across the globe. While this enabled countries to insulate themselves as long as possible and to prepare for its arrival, it resulted in a hugely complex global supply chain. In the figure below from the Airbus presentation, Pierre Perdoux highlighted the non-uniform way that different regions within their supply chain were affected. To give you context, Airbus has 22 production sites spread across the globe, manufacturing various elements of their aircrafts and compiling source parts from some 3,000 approved suppliers. Each supplier had their own challenges, and the complexity was extremely high.

This notion of complexity and unpredictability was also emphasized by Kyle Westwood, Head of Business Development at Elementum. “In March/April we all saw one of these two things: severe demand unpredictability or severe supply shortages.”

For Airbus, the solutions seem straightforward – real-time data from various sources combined with a holistic 360 degree “risk management” – what will the downstream bottlenecks and issues be? But the complexity of this across 10,000 suppliers was, and continues to be, the real challenge. Being able to filter and manipulate the data was paramount. But Airbus saw the need and started implementing changes. “Having been through COVID-19 and changed the way we work, we could never go back to the way things worked before,” commented Pierre Perdoux, SVP, Procurement Operations from Airbus.

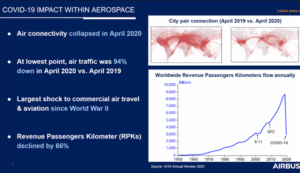

While I’m on the topic of aviation, the comparison between 9-11, the Global Financial Crisis, and COVID-19 on aviation were incomparable (see figure below). Air connectivity collapsed in April 2020. This is important to highlight because this also impacted the supply chain, not simply the air passenger travel market. As Patrick Van Hull, Industry Thought Leader from Kinaxis highlighted in his presentation, “50% of air-freight capacity is in the belly of commercial flights.”

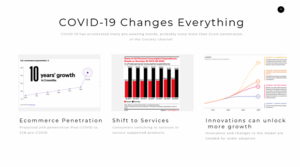

COVID also propelled a number of other broader consumer shifts (see figure below). Bill Papantoniou, Head of Customer Supply Chain at Nestlé Purina EMENA highlighted this point in his presentation well. In the US alone, e-commerce grew 44% in 2020. If you’re interested in its growth globally, this is a great article to read. The other shift noted by Bill was the sharp rise in services or service support products. As the world struggled to find a degree of “normal” in the world, companies tried to understand and forecast the future too. To quote Bill, “You cannot forecast the future, no matter what analytics you have. There are always disruptions. Invest in agility as much as possible.”

The Lessons Learned

In my pre-event article, I posed the question – and hoped – that the vendors that were presenting would provide an educational session as opposed to just pitching their products. Sadly, there was a lot of pitches, but not all of the content presented were sales pitches. I want to cover some of the things I learned.

The event spent a good deal of time talking about prescriptive analytics. Greg Silverman, CEO and Founder of Concentric Inc did a good job of defining this technology. “Risk mitigation, speed, and early detection – this is the foundation of prescriptive analytics. Modelling to allow for risk mitigation and planning through digital twins. What we’ve gotten really good at is looking back at the data and finding trends that impact our business. Prescriptive analytics is not the answer to inventory supply shortages but can assist with allocation. If you allocate to high profit channels, the theory is that your overall profits will rise.”

Kyle Westwood from Elementum contributed an additional piece of insight, which admittedly was designed to set up his sales pitch, but still, it was elegant and hit a solid point. “Planning is not the right framework for dealing with the issues we saw with COVID-19. We need to be able to make good decisions faster.” He went on to note that the tools we typically use to address unknown challenges are email, spreadsheets, comms platforms like MS Teams or Zoom, and the like – these don’t allow for the congregation of shared data/intelligence into a single tool that allows for quick decision making. On this point I agree. I’ll leave the rest of his pitch out of this article, but one could see where the service they are offering would make sense.

Tomorrow’s Supply Chain

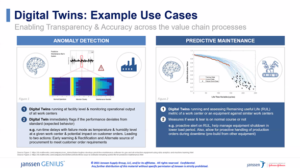

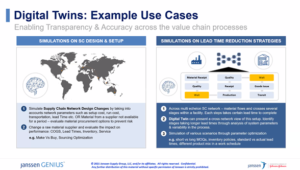

The single-largest future trend noted were digital twins and the integration of AI. Saurabh Verma, Director Value Chain Excellence at Johnson & Johnson expanded this notion very well. Digital twins are completely transforming the way value in the supply chain works. Data is coming in real-time today. This is the key and what makes it so relevant.” He continued by mapping out several digital twin example use cases including anomaly detection, predictive maintenance, simulation on supply chain design and setup, and simulations on lead time reduction and strategies (see figures below for more details).

I’d like to close on what I considered the most comprehensive future vision for the digital supply chain. It came from Patrick Van Hull of Kinaxis. He highlighted several key trends that will shape the future, namely customer centricity, collaboration, and full synchronicity (see his slide below for the full list).

The writing is already on the wall for customer centricity. Consumers are moving online and ecommerce has been shaped by Amazon. Consumers have been groomed to expect more from the supply chain in an ever increasing “me” world. We expect visibility of our orders – from the moment we click ‘Buy Now’, to the courteous email saying our packages were delivered – and the supply chain has a huge role to play in this. This will also only increase as we move into increasingly customized products – four of the last five purchases I’ve made were customized for me or the end recipient.

The Final Verdict

All-in-all FODS 3.0 was a mix for me. I learned about some interesting topics and I got a lot of product pitches thrown at me. If I was a supply chain professional looking for solutions to manage the fall-out from COVID-19, it was worth my time to hear about potential solutions. If I was there to learn something then FODS 3.0 still managed to achieve this in the end, but largely due to the contributions from non-sponsoring presenters. Having said that, insights, innovation, and pitches are a tight line to walk and in the end, having learned something, one would argue it was worth the time.

5 comments

Hello, just wanted to say, I enjoyed this post.

It was inspiring. Keep on posting!

Very good post! We will be linking to this great post on our site.

Keep up the great writing.

I every time spent my half an hour to read this webpage’s content everyday along with a mug of coffee.

I love what you guys are usually up too. This sort of clever work and exposure! Keep up the amazing works guys I’ve added you guys to my own blogroll.

Very well written story. It will be valuable to everyone who utilizes it, including yours truly :). Keep doing what you are doing – looking forward to more posts.

Comments are closed.