Amidst escalating attacks and a seemingly unending crisis, the Red Sea predicament is poised to disrupt trade volumes significantly and pose formidable challenges to shippers’ operational strategies at least in the first half of 2024.

The Suez Canal and the Red Sea serve as vital conduits that jointly handle around 30% of global container traffic, enabling the transportation of goods worth over $1 trillion annually.1

As the Panama Canal grapples with a crisis stemming from low water levels due to severe drought, leading to a significant decline in global trade via Panama Canal, the Red Sea dilemma unfolds as a separate challenge, triggered by Houthi attacks since October 2023, presenting a unique array of obstacles. Ships have been compelled to opt for the more costly and time-consuming route around the Cape of Good Hope, significantly disrupting global supply chains. This shift has led to extended transit times, soaring freight rates, and a surge in carbon emissions.

Vessel Transit Numbers Through the Red Sea

According to a report by UNCTAD, transits through the Suez and Panama Canal nearly halved between October 2021 and January 2024. In 2023, approximately 26,000 vessels traversed the Suez Canal, with container ships constituting 23% of this traffic. Container ships also accounted for the largest share of tonnage, comprising 43% of the total. Presently, Suez Canal transits have plummeted by 42% compared to their peak in the first half of 2023.

Challenges Facing Shippers

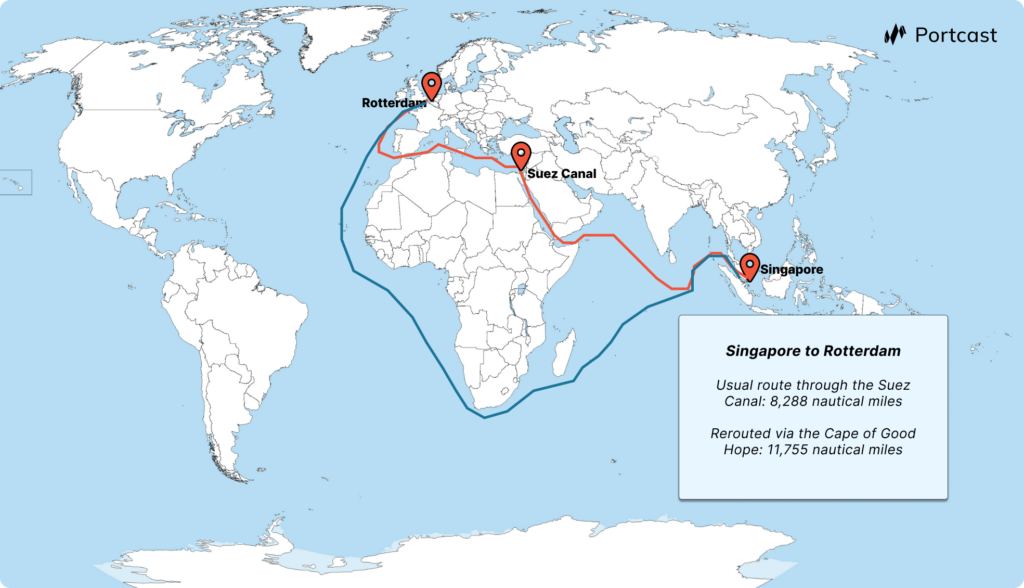

The increase in the distance travelled via the Cape of Good Hope will result in extended transit times, disrupting sailing schedules and compromising service reliability, ultimately leading to delays.

For instance, a journey from Singapore to Rotterdam would encompass 11,755 nautical miles if redirected via the Cape of Good Hope, in contrast to the usual route through the Suez Canal, covering 8,288 miles.

Increase in Distance: Singapore to Rotterdam via the Suez Canal versus Cape of Good Hope (Data and image source: Portcast)

This increased distance has resulted in:

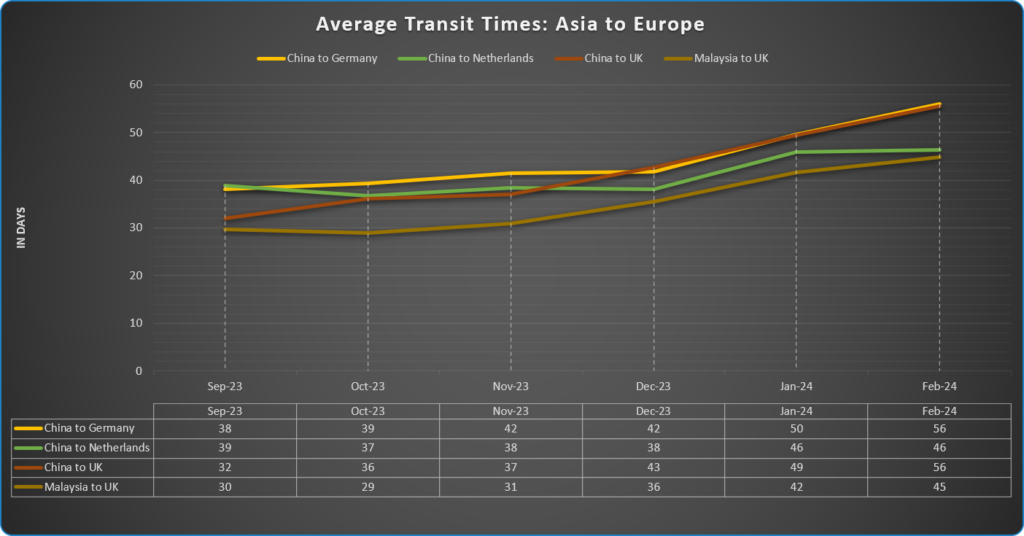

1. Prolonged Transit Times

- South Asia to the US: Selecting the Cape of Good Hope over the Suez Canal route adds approximately 7 days.

- Asia to Europe: Opting for the Cape of Good Hope adds roughly 10 days to the transit period.

2. Increased Shipping Expenses

Mounting insurance premiums are adding to the financial strain on shippers. Marine war risk premiums have surged, reaching as high as 1% of the ship’s value, with a more typical rate hovering around 0.7%. Thus, a vessel transporting goods valued at $50 million would encounter an extra $350,000 in premiums for the brief period it traverses the Red Sea region.

On the other hand, rerouting via the Cape of Good Hope incurs additional fuel costs of up to $1 million for each round trip between the Far East and North Europe, according to industry reports. These added costs will eventually be passed on to shippers. It’s worth noting that shipping expenses for specific routes, especially from Asia to Europe, have surged as much as fivefold.

3. Increased Co2 Emissions

The addition of approximately 4000 nautical miles resulting from rerouting via the Cape of Good Hope will inevitably impact shippers’ environmental ratings, as the extended distance contributes to heightened carbon emissions. According to data from Portcast, routes from:

- South Asia region to Europe: Experience an approximate 50% increase in CO2 emissions.

- South Asia region to the US East Coast: Witness around a 20% rise in CO2 emissions.

Percentage increase in CO2 Emissions along key shipping routes connecting Asia with Europe/US East Coast (Data and image source: Portcast)

The True Impact of Longer Transit Time and Delays

Delays extend their reach beyond mere arrival schedules; they influence various aspects of supply chain operations:

- Direct Impact on Stock Levels: Stock levels undergo direct repercussions, necessitating strategic adjustments. The Just in Time (JIT) strategy is now viewed as too precarious given the prevailing circumstances, prompting specific industries to maintain more extensive inventories than previously.

- Modifications to Vessel Schedules: Related vessels’ schedules undergo revisions and require meticulous replanning for future shipment flows.

- Escalating Supply Chain Costs: The heightened reliance on expedited air freight increases supply chain costs.

- Concerns Over Stock in Transit: Concerns emerge regarding stock in transit, encompassing aspects such as insurance, shelf life, and security. For example, exporters of perishable goods can encounter heightened risk of spoilage caused by delays and rerouting. Moreover, working capital tied up in inventory also increases.

- Extended Unloading Times: Unloading stock at an unforeseen port further prolongs the journey to the intended destination. Certain alternate ports may still lack the requisite infrastructure to manage increased traffic, while port clearance delays compound the setbacks upon stock arrival.

- Growing Concerns Regarding Container Availability: Sourcing empty containers becomes an escalating concern amidst the evolving situation.

What Can Be Helpful for Shippers Now?

The Red Sea disruption, caused by geopolitical tensions, came unexpectedly. However, shippers must quickly ascertain which shipments are affected and to what degree, enabling them to respond effectively to the situation. They need:

- Real-time updates on shipment status and average transit times.

- Timely alerts and warnings regarding possible delays, including port waiting times, loading and unloading delays at transhipment ports, and early access to dependable vessel Estimated Time of Arrivals (ETAs) to help shippers mitigate detention and demurrage charges upon arrival at destination ports.

Having such information can enable businesses to undertake a range of critical actions, including:

- Adjusting inventory plans and evaluating potential impacts on safety stock levels.

- Identifying priority shipments and devising strategies to meet inventory demands promptly.

- Communicating delays to operational stakeholders such as trucking companies, warehouses, and customs, facilitating proactive adjustments.

- Notifying manufacturing plants or customers about delays and offering insight into the underlying causes of disruptions.

Conclusion

As unforeseen events like these persist in affecting global supply chains and repeatedly challenging their resilience, technology has emerged as a boon for maritime stakeholders in managing such disruptions, striving to minimise their impact wherever possible. For shippers mainly, the key lies in staying vigilant for timely and reliable updates on shipment statuses. This foresight can empower them to act proactively, mitigating potential impacts before they escalate, thus ensuring smooth operations through turbulent times!

About the author

Nidhi Gupta is the CEO and Co-founder of Portcast, a real-time container tracking and exceptions management solution for ocean freight. With over a decade of leadership and C-level consulting experience in strategy and operations, Nidhi champions digitization and innovation in supply chain logistics.

Nidhi Gupta is the CEO and Co-founder of Portcast, a real-time container tracking and exceptions management solution for ocean freight. With over a decade of leadership and C-level consulting experience in strategy and operations, Nidhi champions digitization and innovation in supply chain logistics.